Vancouver Real Estate Market Update

Will the Immediate halt of the offshore ‘millionaire visa scheme’ affect our local property prices?

The media has quoted a few West Vancouver Realtors as saying “it will affect 80 to 90 percent of the buying in West Vancouver.” As a correlation, the Vancouver West Side also has a high percentage of offshore buyers in the sub areas of Kerrisdale, Quilchena, Mackenzie Heights and Shaughnessy. I have been told from reputable sources that the scrapped visa scheme will have little negative effect on our Vancouver real estate market. Firstly, the offshore buyers in question were not all applying for visas. They are and continue to be buying property as a nonresident with a minimum of 35% percent down and either renting the newly purchased property or leaving it vacant. Secondly a non-resident can still get a mortgage up to 1.5 million with either TD or Scotia bank. Finally, offshore buyers are generally focused on specific West Side subareas as previously mentioned and the majority of the sales are in the 2.75 million dollar plus bracket. This makes up a small portion of our overall Vancouver real estate market. If you own in these sub areas it is more than likely the property down the street that sold for a huge price was sold to an offshore non-resident.

Will the CMHC increased mortgage insurance premiums affect our real estate market?

The increase in mortgage insurance premiums should not have any negative effect on our local real estate market. In 2013, the average CMHC insured loan at 95% loan-to-value was $248,000. Using these figures, the higher premium will result in an increase of approximately $5 to the monthly mortgage payment for the average Canadian homebuyer. This is not expected to have a material impact on the housing market. The increase is more of a hedge to protect CMHC against any possible future downfalls of the Canadian housing market particularly foreclosures. At this time, the Canadian foreclose rate is at an all time low of .006 percent.

The following summaries discuss Vancouver’s market by area:

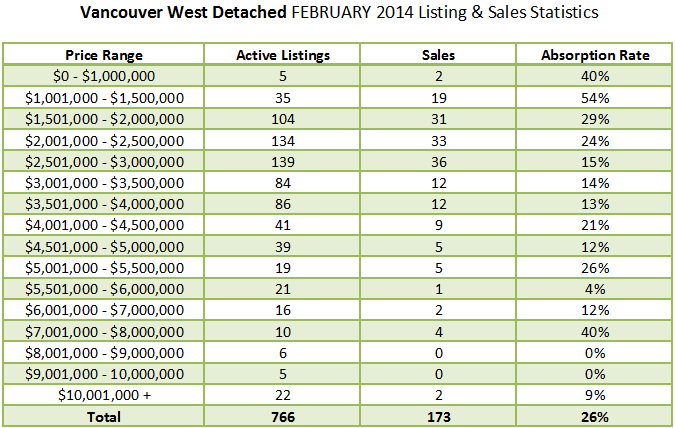

Vancouver West Detached

The West Side was very active in February right up to the 2.5 million dollar price range. Houses with mortgage helpers (suites) in the sub 1.5 million ranges are at times receiving multiple offers. The 3 million to 4.5 million ranges has decent activity with an average of a 14% absorption rate. The overall activity was and continues to be very good with an absorption rate of 26% but buyers are price sensitive and will pass over any listing that is overpriced.

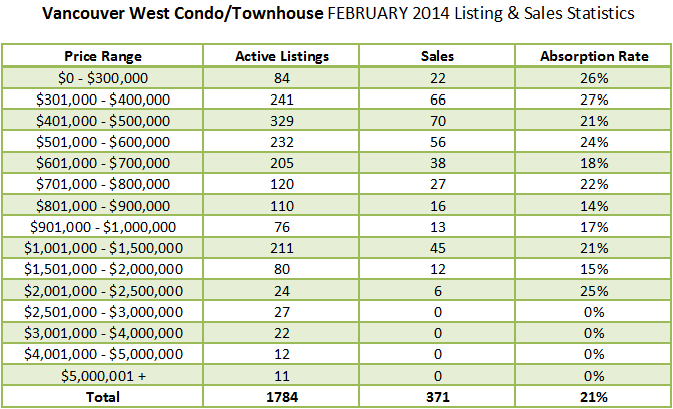

Vancouver West Attached

Sales for Condo’s are steady right up to the 600 thousand mark. The activity drops off slightly until the 1 million to 1.5 million price range. The activity almost comes to a halt from the 2.2 million and up price range. In fact, there were 60 MLS listings offered for sale above 2.5 million in the month of February with zero sales. The Townhouse market is moving at a slower pace than the condos particularly in the 800 thousand dollar and above price range. The overall absorption rate is 21% and that is good for sellers but correct pricing is extremely important.

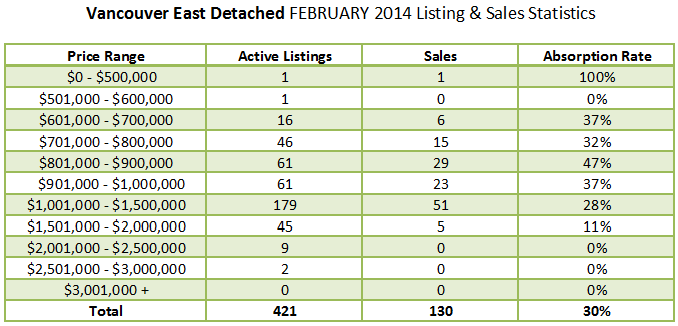

Vancouver East Detached

The East Side detached market is HOT right up to 1.4 million. If a new listing is located in the Main, Fraser, Mount Pleasant or Grandview sub area and has a mortgage helper there is a very good chance that property will receive multiple offers. The current absorption rate is 30% but it is important to note that all of the activity in under the 1.4 million mark. There are 56 listings priced over 1.5 million and only 5 sold.

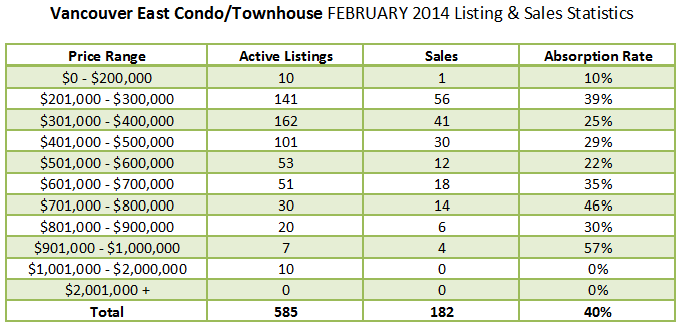

Vancouver East Attached

The condo and townhouse market on the East Side is extremely active with an overall absorption rate of 40%. The strongest activity was in the 200 to 300 thousand price range. There was good activity right up to the 1 million dollar mark. Half duplexes continue to sell quickly. Many young families are choosing to spend 700 to 800 thousand for a duplex that is 5 years old or less rather than buying a fixer upper detached house on the East Side.

Market conditions vary by location, type and style of property. For more specific information please call or email me.

Vancouver Listing and Sale Charts: